كذلك، فإن هذه اللعبة ليست مجرد استعراضٍ مبهرٍ للرموز المصرية، بل هي مبنية على أساسٍ متين! تخيّل المكاسب الهائلة وأنت تستكشف تلك اللوحات، حيث قد تزيد خياراتك من ثروتك، بالإضافة إلى التشويق المثير! ولكن، انتظر، فهناك المزيد – غرفةٌ مليئةٌ بالمكافآت!

أفضل 5 ألعاب فيديو للمراكز

انضم إلى كازينو هابير لتجربة ألعاب مثيرة عبر الإنترنت! جرّب لعبة الروليت، فهي الأفضل على الإطلاق. تتميز لعبة لاكي فرعون ديلوكس فورتشن برسومات جديدة رائعة وسلاسة في الأداء. أما لعبة الباكارات، فتتميز بسهولة التحكم وربح أعلى، مما يجعلها بلا شك الأفضل بين ألعاب الفيديو!

استمتع بألعاب القمار بأموال حقيقية داخل MI

أحدث مؤشرات الكفاءة من أبحاث الأدوات الموثوقة. لتحقيق مكاسب كبيرة، قد يتطلب الأمر بعض الحظ رقاقة كازينو 1xbet المجانية والمثابرة. تُصنف المزايا (المُركزة على 5) خطوط الدفع والمكافآت ونسبة العائد للاعب (RTP) على أنها ثابتة وسهلة الاستخدام. لذا، فإن هذا الموقع، بحصوله على 3.91 من 5، واحتلاله المركز 183 من أصل 4104، يتميز بتوازنه. ثبّت التطبيق الرسمي واستمتع بلعبة Pharaoh Luck في أي وقت وفي أي مكان مع مكافآت حصرية للهواتف المحمولة!

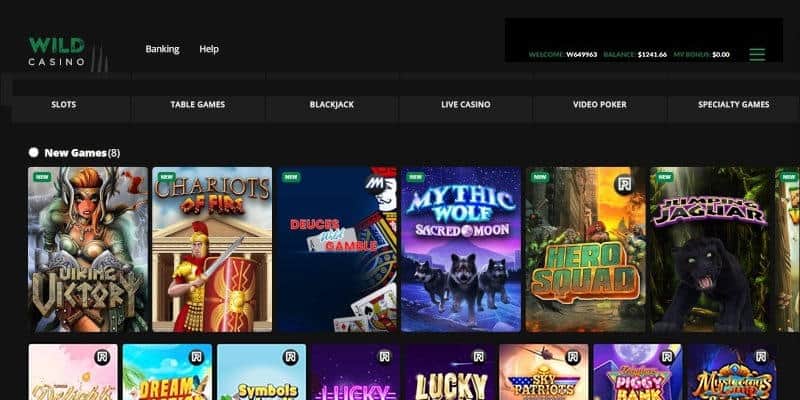

لقد جمعنا قائمة بأفضل الكازينوهات الأمريكية على الإنترنت لمساعدتك في اختيار الأنسب لك. جرّب لعبة Pharaoh's Luck مجانًا على موقعنا الإلكتروني لتتعرف على طريقة اللعب قبل المراهنة بأموال حقيقية. يجد معظم اللاعبين الجدد في لعبة Pharaoh's Luck الجديدة النسخة التجريبية مفيدة. تعمل هذه اللعبة تمامًا مثل اللعبة الأصلية، ولكن دون الحاجة إلى المراهنة بأموال حقيقية. لذلك، يفضل العديد من لاعبي ماكينات القمار تجربة هذه اللعبة.

تُمنح الجوائز من خلال ملء البكرات بالكامل برموز غريبة خلال جولة إضافية نشطة. تُعد لعبة ماكينة القمار "فرصة الفرعون" في الكازينو المحلي تجربة رائعة ومختلفة عن الموانئ التقليدية المستوحاة من مصر القديمة ذات الإضاءة الخافتة. هذا يعني أن دورات الربح تحدث باستمرار، ولكن جوائز الدولارات الكبيرة تُمنح عادةً من خلال الجولات الإضافية المُفعّلة بدلاً من اللعب العادي.

لهذا السبب، نقدم أرباحًا منتظمة ومعقولة الحجم. الآن بعد أن عرفت نسبة العائد للاعب (RTP) لكل لعبة سلوت، عليك أيضًا معرفة مدى تقلبها. ثم، انقر على الزر البنفسجي العلوي ودع البكرات الجديدة تدور. الحد الأدنى للرهان هو 0.15 دولار، والحد الأقصى هو 300 دولار. استخدم زري "و" و"ناقص" لتعديل قيمة رهانك الإجمالي. أخيرًا، يتيح لك زر "الصوت" الجديد التحكم في إعدادات الصوت للعبة.

لعبة Pharaoh's Chance هي لعبة كازينو يمكنك لعبها عبر الإنترنت. استمتع بلعبة Pharaoh's Chance في كازينو Spinight، حيث يحصل اللاعبون الجدد على 200 دورة مجانية مع مكافأة قبول رائعة بقيمة 3750 دولارًا. يؤدي ظهور ثلاثة رموز مكافأة على البكرات 1 و2 و3 خلال الدورات المجانية إلى إعادة تفعيل المكافأة. يتم تفعيل المكافأة أيضًا عند ظهور ثلاثة رموز مكافأة إضافية على البكرات 1 و2 و3. لقد لعبنا البوكر في لعبة Pharaoh's Chance من Spinight لساعات، وكان الجو أشبه بكازينو حقيقي! المكافآت الجديدة في لعبة Pharaoh's Chance سخية، فقد حصلت على 50 دورة مجانية!

يُعدّ رمز المكسرات الجديد مُجزيًا للغاية، حيث يُتيح لك ربح ما يصل إلى 10,000 ضعف قيمة رهانك على الخط عند ظهور خمسة رموز منه على خط دفع ديناميكي. يضمن تقلبها المتوسط مزيجًا متوازنًا من المكاسب الصغيرة المتكررة والأرباح الكبيرة العرضية. تجمع هذه اللعبة بين عناصر ماكينات القمار الكلاسيكية ورسومات متطورة وعروض ترفيهية، مما يجعلها مناسبة لجميع اللاعبين. جرّب لعبة Pharaohs Chance من IGT، وهي لعبة سلوتس كازينو رائعة بخمس بكرات و15 خط دفع، لتستمتع بسحر مصر القديمة. 5 بكرات مع 15 خط دفع (20 خط دفع خلال الدورات المجانية). Slotsspot.com – يساعدك على اللعب بذكاء والاستمتاع بوقتك.

هل توجد أي ألعاب سلوتس على الإنترنت مشابهة للعبة Pharaoh's Fortune؟

يمكن النظر إلى الأمر ببساطة على أنه مقدار ما سيحصل عليه اللاعب المحترف عادةً، على مدار سنوات، مقابل كل 100 دولار ينفقها على لعبة كازينو. وبغض النظر عن الوعد بمضاعف محتمل 6x في ميزة المكافآت، فإن ربح 10000 ضعف رهان الخط لا يزال هو الجائزة الكبرى. اجمع 5 أرقام 1 واربح 10000 ضعف رهان الخط، لتحصل على أقصى ربح يصل إلى 60100 دولار. يتم تثبيت خطوط الدفع من 15، وتزداد حتى 20 في ميزة المكافآت، لذا فإن أفضل طريقة لتعديل رهانك هي تغيير الرهان لكل خط.

يستوحي كل من الموضوع والصور من علم المصريات، الذي يضم الفراعنة وغيرهم من الرموز التاريخية، إلا أن جون هانتمان أكثر تقدماً وتألقاً. يُعد جون هانتمان ومنشور توت عنخ آمون إنتاجاً من شركة براغماتيك بلاي، مما يمنح اللاعبين متعة جديدة في المغامرة. وبشكل عام، ترتقي لعبة "فرصة الفرعون" إلى مستوى اسمها، حيث تزيد قيمة الإصدار الجديد من اللعبة 20 ضعف قيمة الإصدار الأصلي، وتقدم مكافأة مميزة تصل إلى 10000 ضعف قيمة الإصدار الأصلي.

تُحدد اللعبة على 5 بكرات و3 صفوف، ويمكنك أيضًا تجربة لعبة Steeped Wilde واستكشاف مصر القديمة بحثًا عن أسرارها الخفية. تشمل مميزات لعبة السلوتس دورات مجانية بنسبة 100%، ومكافآت، ورموز Wild، وجائزة كبرى تراكمية. تُعد هذه اللعبة من أفضل ألعاب الكازينو الاجتماعية، مثل MGM Harbors Alive وPop Music! اكتشف جميع عروضنا الخاصة للعب في أفضل كازينو على الإنترنت.